Multiple Choice

Table 18-6

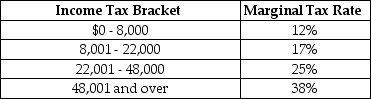

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Calculate the income tax paid by Sasha, a single taxpayer with an income of $60,000.

A) $22,800

B) $14,400

C) $13,800

D) $13,642

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Figure 18-9<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-9

Q33: Which of the following summarizes the information

Q155: Table 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Table 18-1

Q193: Explain the effect of price elasticities of

Q199: If your income is $92,000 and you

Q222: If you pay $3,000 in taxes on

Q222: According to projections for 2016 by the

Q228: Which of the following groups had the

Q231: The Gini coefficient for the United States

Q232: The decision to make the U.S.income tax