Multiple Choice

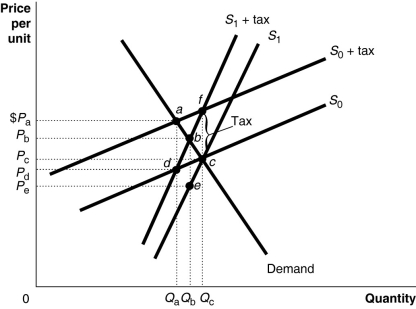

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

Figure 18-2 shows a demand curve and two sets of supply curves,one set more elastic than the other.

-Refer to Figure 18-2.If the government imposes an excise tax of $1.00 on every unit sold,the government's revenue from the tax is represented by the area

A) (PaPc × Qa) if the supply curve is S0 and (PbPc × Qb) if the supply curve is S1.

B) (PaPd × Qa) if the supply curve is S0 and (PbPe × Qb) if the supply curve is S1.

C) (PaPe × Qa) under either supply curve.

D) (PbPe × Qb) under either supply curve.

Correct Answer:

Verified

Correct Answer:

Verified

Q130: Of the following sources of tax revenue

Q168: For a given supply curve, how does

Q179: A personal exemption refers to<br>A)the tax rate

Q185: The Gini coefficient is measured by<br>A)summing up

Q186: The median voter theorem states that the

Q198: The median voter model implies that<br>A)many people

Q200: Measures of poverty (for example, the poverty

Q219: Figure 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-1

Q223: Figure 18-4<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-4

Q236: In the United States, the federal income