Essay

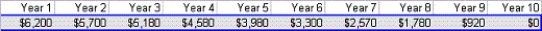

Now assume that the project has an abandonment option.At the end of each year you can abandon the project for the values given below:  For example,suppose that year 1 cash flow is $400.Then at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So the future cash flows after abandonment should disappear.)

For example,suppose that year 1 cash flow is $400.Then at the end of year 1,you expect cash flow for each remaining year to be $400.This has an NPV of less than $6200,so you should abandon the project and collect $6200 at the end of year 1.Estimate the mean and standard deviation of the project with the abandonment option.How much would you pay for the abandonment option? (Hint: You can abandon a project at most once.Thus in year 5,for example,you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned.Also,once you abandon the project,the actual cash flows for future years will 0.So the future cash flows after abandonment should disappear.)

Correct Answer:

Verified

The mean and standard deviati...

The mean and standard deviati...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Which of the following distributions is most

Q8: Bidding for contracts is an example of

Q10: Which of the following are not among

Q12: A key objective in cash flow models

Q14: Suppose that Coke and Pepsi are fighting

Q15: Suppose a 1% increase in market share

Q27: The value at risk (VAR) is typically

Q37: Uncertain timing and the events that follow

Q43: In financial simulation models,the value at risk

Q48: Suppose we have a 0-1 output for