Essay

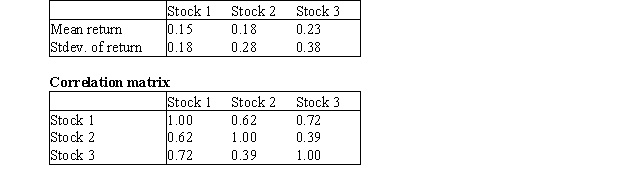

Assume that you are given the following means,standard deviations,and correlations for the annual return on three stocks.

The correlation between stocks 1 and 2 is 0.62,between stocks 1 and 3 is 0.72,and between stocks 2 and 3 is 0.39.You have $12,000 to invest and can invest no more than 55% of your money in any single stock.Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

The correlation between stocks 1 and 2 is 0.62,between stocks 1 and 3 is 0.72,and between stocks 2 and 3 is 0.39.You have $12,000 to invest and can invest no more than 55% of your money in any single stock.Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A product can be produced on four

Q10: Each year, a computer company produces up

Q11: Suppose that later in the year, venison

Q12: The production manager believes the cost of

Q14: In network models of transportation problems,arcs represent

Q27: A minimum cost network flow model (MCNFM)has

Q28: A global optimal solution is not necessarily

Q40: A company blends silicon and nitrogen to

Q53: Any integer programming problem involving 0-1 variables

Q82: A local optimal solution is better than