Essay

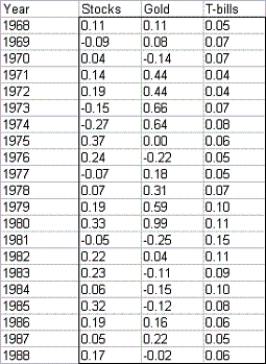

The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them.Suppose you are trying to determine what percentage of your money you should invest in T-bills,gold,and stocks.The table below lists the annual returns (percentage changes in value)for these investments for the years 1968-1988.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A 0-1 variable,also called a binary variable,is

Q14: In nonlinear models,which of the following statements

Q30: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2053/.jpg" alt="If refers

Q30: In aggregate planning models,the number of workers

Q34: A total of 160 hours of labor

Q35: The flow balance constraint for each transshipment

Q36: What happens to the revenue when the

Q49: When we solve a linear programming problem

Q79: The LP relaxation of an integer programming

Q82: An oil company produces oil at two