Multiple Choice

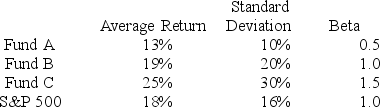

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The following data are available relating to

Q15: The following data are available relating to

Q19: You want to evaluate three mutual funds

Q20: In a particular year, Razorback Mutual Fund

Q21: The following data are available relating to

Q22: In a particular year, Razorback Mutual Fund

Q38: Mutual funds show _ evidence of serial

Q49: The Sharpe, Treynor, and Jensen portfolio performance

Q52: Suppose you purchase 100 shares of GM

Q56: Hedge funds I) are appropriate as a