Multiple Choice

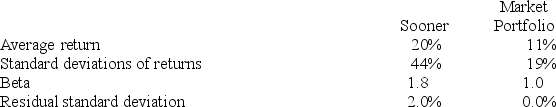

The following data are available relating to the performance of Sooner Stock Fund and the market portfolio:

The risk-free return during the sample period was 3%.

Calculate the information ratio for Sooner Stock Fund.

A) 1.53

B) 1.30

C) 8.67

D) 31.43

E) 37.14

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Suppose you buy 100 shares of Abolishing

Q28: Suppose two portfolios have the same average

Q29: Suppose the risk-free return is 3%. The

Q35: Suppose you purchase one share of the

Q42: Most professionally managed equity funds generally<br>A) outperform

Q56: Suppose two portfolios have the same average

Q58: The Modigliani M2 measure and the Treynor

Q59: Suppose two portfolios have the same average

Q61: Suppose two portfolios have the same average

Q72: A pension fund that begins with $500,000