Multiple Choice

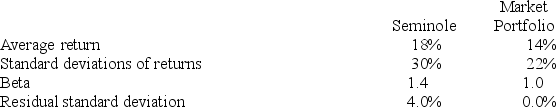

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Risk-adjusted mutual fund performance measures have decreased

Q23: The M2 measure was developed by<br>A) Merton

Q26: The following data are available relating to

Q27: In a particular year, Aggie Mutual Fund

Q27: Suppose you purchase one share of the

Q33: The following data are available relating to

Q37: If an investor has a portfolio that

Q43: The comparison universe is not<br>A) a concept

Q44: _ developed a popular method for risk-adjusted

Q65: Suppose the risk-free return is 6%. The