Multiple Choice

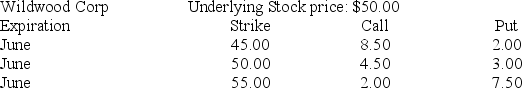

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with calls, you would ________.

A) buy the 55 call and sell the 45 call

B) buy the 45 call and buy the 55 call

C) buy the 45 call and sell the 55 call

D) sell the 45 call and sell the 55 call

Correct Answer:

Verified

Correct Answer:

Verified

Q74: Which one of the following is the

Q75: You purchase one MBI July 90 call

Q76: You purchase one MBI July 125 call

Q77: An investor is bearish on a particular

Q78: An Asian put option gives its holder

Q80: You own a stock portfolio worth $50,000.

Q81: An investor purchases a long call at

Q82: An Asian call option gives its holder

Q83: A futures call option provides its holder

Q84: Suppose you purchase one Texas Insurance August