Multiple Choice

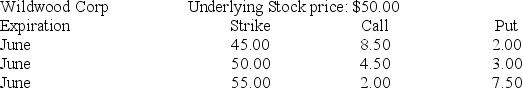

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A) $1,050

B) $650

C) $400

D) $400 income rather than cost

Correct Answer:

Verified

Correct Answer:

Verified

Q59: You are convinced that a stock's price

Q60: The common stock of the Avalon Corporation

Q61: A European call option gives the buyer

Q62: A call option on Brocklehurst Corp. has

Q63: You are cautiously bullish on the common

Q65: You buy a call option and a

Q66: The common stock of the Avalon Corporation

Q67: A writer of a call option will

Q68: Why is the holder of an option

Q69: Which of the following strategies makes a