Multiple Choice

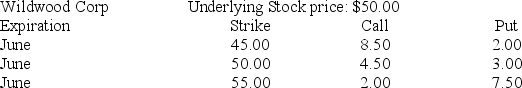

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with puts, you would ________.

A) sell the 55 put and buy the 45 put

B) buy the 45 put and buy the 55 put

C) buy the 55 put and sell the 45 put

D) sell the 45 put and sell the 55 put

Correct Answer:

Verified

Correct Answer:

Verified

Q13: You purchase one MBI March 120 put

Q14: If the gross profit is positive and

Q15: _ option can only be exercised on

Q16: You purchase one MBI July 120 put

Q17: _ is the most risky transaction to

Q19: A put option on Dr. Pepper Snapple

Q20: You sell one MBI July 90 call

Q21: You purchase a call option on a

Q22: At contract maturity the value of a

Q23: In 1973, trading of standardized options on