Multiple Choice

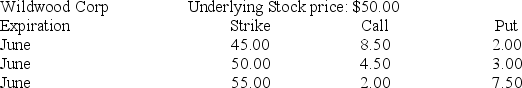

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Suppose you establish a bullish money spread with the puts. In June the stock's price turns out to be $52. Ignoring commissions, the net profit on your position is ________.

A) $500

B) $700

C) $200

D) $250

Correct Answer:

Verified

Correct Answer:

Verified

Q26: An option with a payoff that depends

Q27: The common stock of the Avalon Corporation

Q28: An American put option gives its holder

Q29: A covered call strategy benefits from what

Q30: You buy a call option on Summit

Q32: Exchange-traded stock options expire on the _

Q33: You write one MBI July 120 call

Q34: The writer of a put option _.<br>A)

Q35: Which one of the statements about margin

Q36: Which of the following expressions represents the