Multiple Choice

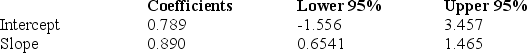

You run a regression of a stock's returns versus a market index and find the following:

Based on the data, you know that the stock ________.

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to .890

C) has a beta that is likely to be anything between .6541 and 1.465 inclusive

D) has no systematic risk

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Compensation of money managers is _ based

Q34: Research has identified two systematic factors that

Q35: In a well-diversified portfolio, _ risk is

Q36: According to the CAPM, what is the

Q37: Beta is a measure of _.<br>A) total

Q39: The risk premium for exposure to aluminum

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6474/.jpg" alt=" What is the

Q41: In a world where the CAPM holds,

Q42: If the beta of the market index

Q43: One of the main problems with the