Multiple Choice

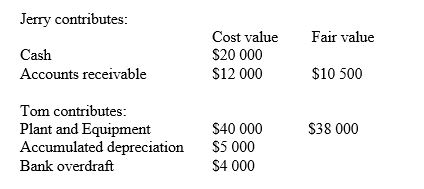

Tom and Jerry are two sole traders that have joined together to form a partnership by combining their net assets.

Jerry contributes:

What will be the amount shown in the accumulated depreciation account on formation of the partnership of Tom and Jerry?

A) $Nil

B) $2000

C) $3000

D) $5000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Which statement concerning drawings by partners in

Q21: The variable capital balances method (method 1),

Q22: Macy and John have capital account balances

Q23: Which of the following would normally be

Q24: The text refers to two methods of

Q26: When non-current assets are contributed by a

Q27: A partner's allocation of the partnership's profit

Q28: Which of the following is not an

Q29: Sole proprietors, Johnny and Simon, decide to

Q30: The partnership agreement of Snowy and