Essay

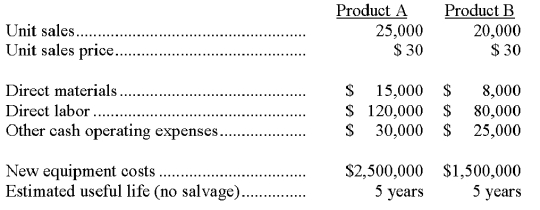

A company is trying to decide which of two new product lines to introduce in the coming year. The company requires a 12% return on investment. The predicted revenue and cost data for each product line follows:

The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

Correct Answer:

Verified

*Annual depreciation:

A $2,500,000/5 yrs...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

A $2,500,000/5 yrs...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The _ is the rate that yields

Q94: For each of the capital budgeting methods

Q95: Daniels Corporation is considering the purchase of

Q96: A capital budgeting method that considers how

Q98: Capital budgeting decisions usually involve analysis of:<br>A)

Q100: The net present value decision rule is:

Q104: A company produces two boat models, Montauk

Q153: The decision to accept an additional volume

Q162: The net present value decision rule requires

Q166: _ is the process of analyzing alternative