Essay

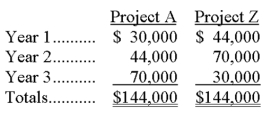

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

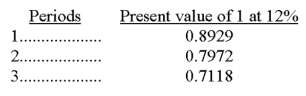

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Correct Answer:

Verified

(1) Project Z becaus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Neither the payback period nor the accounting

Q11: The time value of money is considered

Q54: The _ is computed by discounting the

Q78: Identify the five steps involved in managerial

Q144: A company can buy a machine that

Q146: Coffer Co. is analyzing two projects for

Q147: A disadvantage of using the payback period

Q151: A limitation of the internal rate of

Q153: Which one of the following methods considers

Q190: A company manufactures two products. Each unit