Essay

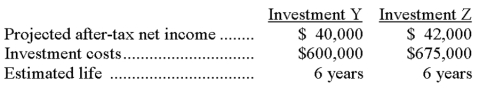

A company has a decision to make between two investment alternatives. The company requires a 10% return on investment. Predicted data is provided below:

The present value of an annuity for 6 years at 10% is 4.3553. This company uses straight-line depreciation.

Required:

(a) Calculate the net present value for each investment.

(b) Which investment should this company select? Explain.

Correct Answer:

Verified

(a)

(b) Select Inves...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(b) Select Inves...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Parker Plumbing has received a special one-time

Q24: Marsden manufactures a cat food product called

Q25: A company is considering a proposal to

Q26: The calculation of the payback period for

Q27: The process of restating future cash flows

Q29: Bower Co. is reviewing a capital investment

Q30: The accounting rate of return uses cash

Q31: The rate that yields a net present

Q32: A company is considering purchasing a machine

Q33: Patrick Corporation inadvertently produced 10,000 defective personal