Essay

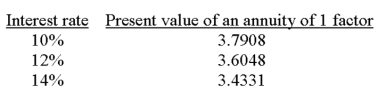

A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Correct Answer:

Verified

Investment/Annual net cash flows = $60,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The break-even time (BET) method is a

Q13: Product A requires 5 machine hours per

Q14: The payback method of evaluating an investment

Q16: A company inadvertently produced 6,000 defective portable

Q17: The following present value factors are provided

Q18: Axle Company can produce a product that

Q19: A company puts four products through a

Q20: Peters, Inc. sells a single product and

Q86: Significant sunk costs are relevant to decisions

Q110: When computing payback period, the year in