Essay

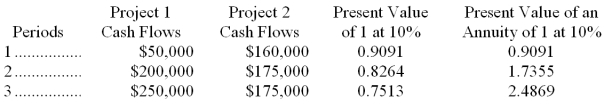

Braybar Company is deciding between two projects. Each project requires an initial investment of $350,000. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Braybar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Use net present value to determine which project should be pursued and explain why.

Correct Answer:

Verified

Both projects have a positive net presen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: The following present value factors are provided

Q18: Axle Company can produce a product that

Q19: A company puts four products through a

Q20: Peters, Inc. sells a single product and

Q21: A company produces three different products that

Q23: Parker Plumbing has received a special one-time

Q24: Marsden manufactures a cat food product called

Q25: A company is considering a proposal to

Q26: The calculation of the payback period for

Q27: The process of restating future cash flows