Essay

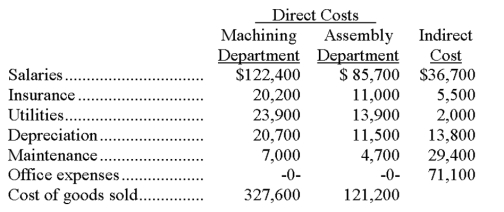

Renton Co. has two operating (production) departments supported by a number of service departments. The following information was collected for a recent period:

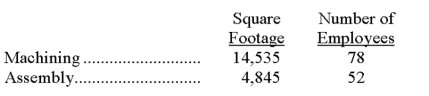

Indirect costs are allocated as follows: salaries on the basis of sales, office expenses on the basis of the number of employees, and all other costs on the basis of square footage. Additional information about the production departments follows:

Sales for the Machining Department are $724,404 and sales for the Assembly Department are $356,796.

Determine the departmental contribution to overhead and the departmental net income for each production department.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: If a firm uses activity-based costing to

Q7: Yoho Company reported the following financial numbers

Q8: The following is taken from Ames Company's

Q9: Unit costs can be significantly different when

Q11: A company rents a small building with

Q14: Departmental contribution to overhead is calculated as

Q16: Under traditional cost allocation methods, low-volume complex

Q46: A _ is a factor that causes

Q46: Return on investment is a useful measure

Q62: The _ is a report of the