Essay

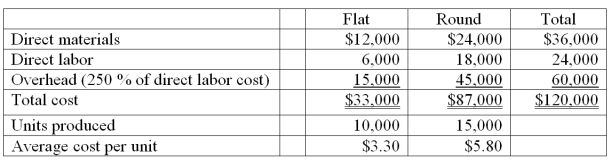

Larabee Company produces two types of product, flat and round, on the same production line. For the current period, the company reports the following data.

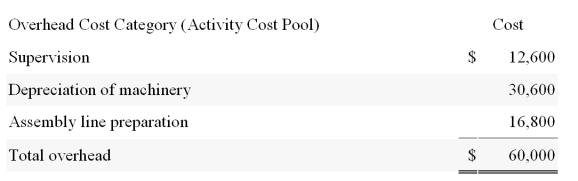

Larabee's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.

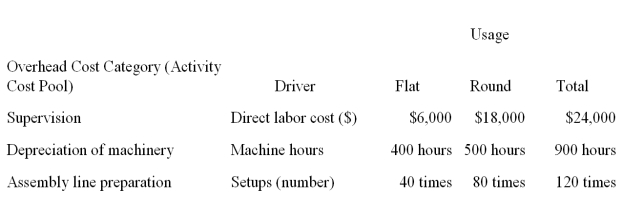

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Correct Answer:

Verified

The average cost of flat increases and t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Joint costs can be allocated either using

Q112: Regardless of the system used in departmental

Q113: An expense that does not require allocation

Q115: Community Technical College allocates administrative costs to

Q116: Naples operates a retail store and has

Q118: In a responsibility accounting system:<br>A) Controllable costs

Q119: Allocations of joint product costs can be

Q120: Investment center managers are evaluated on their

Q122: The concepts of direct costs and controllable

Q170: A selling department is usually evaluated as