Essay

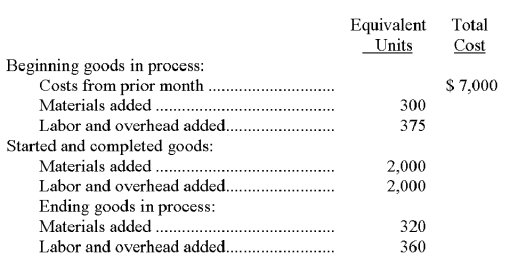

Refer to the following information about the Dipping Department of the Indiana Factory for the month of August. Indiana Factory uses the FIFO method of inventory costing.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned all units that were completed and transferred during August.

Correct Answer:

Verified

Correct Answer:

Verified

Q154: A company uses the weighted average method

Q155: Process costing is applied to operations with

Q156: The number of equivalent units of production

Q157: A _ contains features of both process

Q158: In process cost accounting, the classification of

Q160: On a process cost summary, the total

Q161: A unique feature of process costing systems

Q162: In process cost accounting, direct labor includes

Q163: Aniston Enterprises manufactures stylish hats for sophisticated

Q164: Prepare the required general journal entries to