Essay

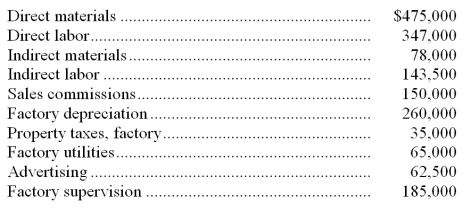

The predetermined overhead allocation rate for Millay Manufacturing is based on estimated direct labor costs of $350,000 and estimated factory overhead of $770,000. Actual costs incurred were:

a. Calculate the predetermined overhead rate and calculate the overhead applied during the year.

b. Determine the amount of over- or underapplied overhead and prepare the journal entry to eliminate the over- or underapplied overhead assuming that it is not material in amount.

Correct Answer:

Verified

a. Predetermined overhead rate...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: When factory payroll for indirect labor is

Q61: Bard Manufacturing uses a job order cost

Q62: Describe the use of the Factory Payroll

Q64: A company that uses a job order

Q65: A job cost sheet includes:<br>A) Direct materials,

Q68: M.A.E. charged the following amounts of overhead

Q69: The direct materials section of a job

Q70: A system of accounting for production operations

Q71: Any material amount of under- or overapplied

Q206: A time ticket is a source document