Essay

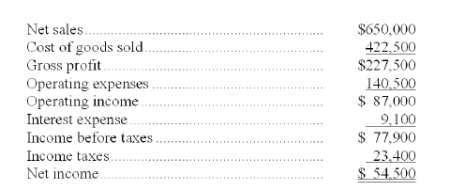

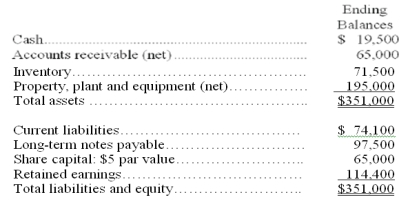

A company's calendar-year financial data are shown below. The company had total assets of $339,000 and total equity of $144,400 for the prior year. No additional shares were issued during the year. The December 31 market price per share is $49.50. Cash dividends of $19,500 were paid during the year. Calculate the following ratios for the company:

(a) debt ratio

(b) equity ratio

(c) debt-to-equity ratio

(d) times interest earned

(e) total asset turnover

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Three of the most common tools of

Q77: In horizontal analysis the percent change is

Q78: A rough guideline states that for a

Q79: The following selected financial information for a

Q80: A common focus of financial statement users

Q83: Profitability is the ability to generate future

Q85: Comparative calendar year financial data for a

Q86: Financial reporting refers to:<br>A) The application of

Q87: Annual cash dividends per share divided by

Q89: Evaluation of company performance does not include