Essay

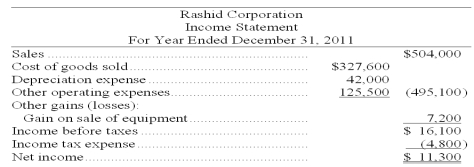

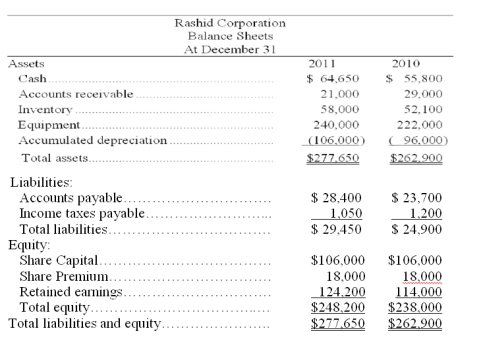

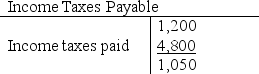

Based on the following income statement and balance sheet for Rashid Corporation, determine the cash flows from operating activities using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The statement of cash flows is divided

Q19: Probably the most important section of the

Q150: Which of the following transactions or events

Q151: The following selected account balances are taken

Q152: The accountant for Robinson Company is preparing

Q153: Managers only use the statement of cash

Q154: The accountant for Robinson Company is preparing

Q157: Investing activities include: (a) the purchase and

Q159: Which one of the following is representative

Q160: Equipment costing $100,000 with accumulated depreciation of