Essay

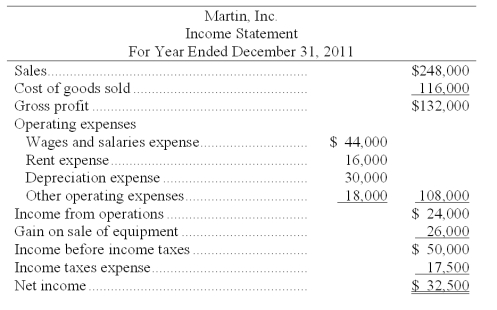

Martin, Inc.'s, income statement is shown below. Based on this income statement and the other information provided, calculate the net cash provided by operations using the indirect method.

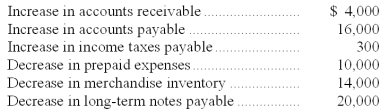

Additional information:

Beginning income taxes payable + Income taxes expense - Cash paid for taxes = Ending income taxes payable

Beginning income taxes payable + Income taxes expense - Cash paid for taxes = Ending income taxes payable

Cash paid for taxes = $17,200

Correct Answer:

Verified

Correct Answer:

Verified

Q104: A main purpose of the statement of

Q120: A cash equivalent is an investment that:<br>A)

Q121: Use the following income statement and information

Q123: A company reported operating cash flows in

Q124: Stojko Corporation had a net decrease in

Q127: A machine with a cost of $130,000

Q128: The cash flow on total assets ratio

Q130: The purchase of long-term assets by issuing

Q155: The cash flow on total assets ratio

Q174: The reporting of investing and financing activities