Essay

A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295, to yield the buyers a 12% return. The company uses the effective interest amortization method. Interest is paid semiannually each June 30 and December 31.

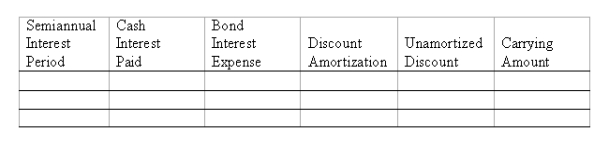

(1) Prepare an amortization table for the first two payment periods using the format shown below:

(2) Prepare the journal entry to record the first semiannual interest payment.

(2) Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

6/30/:

6/30/:

Cash payment: $1,000,000 x 10% x...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cash payment: $1,000,000 x 10% x...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q54: Bonds that have interest coupons attached to

Q55: The debt-to-equity ratio is calculated by dividing

Q56: The present value of an annuity factor

Q58: The carrying amount of bonds at maturity

Q60: Which of the following statements is ?<br>A)

Q61: Mortgage contracts grant the lender the right

Q62: On October 1, a $30,000, 6%, 3-year

Q63: A company borrowed $50,000 cash from the

Q64: On January 1, a company issues bonds

Q121: A discount on bonds payable occurs when