Essay

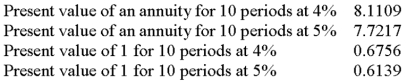

On January 1, a company issues bonds with a par value of $300,000. The bonds mature in 5 years, and pay 8% annual interest, payable each June 30 and December 31. On the issue date, the market rate of interest for the bonds is 10%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Correct Answer:

Verified

Present value of principal $30...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: A company borrowed cash from the bank

Q24: A company previously issued $2,000,000, 10% bonds,

Q25: The carrying amount (book value) of a

Q29: The present value of an annuity factor

Q62: The rate of interest that borrowers are

Q72: Bonds issued in the names and addresses

Q126: Debentures always have specific assets of the

Q142: How are bond issue prices determined?

Q172: When applying equal total payments to a

Q192: On January 1, Year 1 a company