Essay

A company purchased two new delivery vans for a total of $250,000 on January 1, Year 1. The company paid $40,000 cash and signed a $210,000, 3-year, 8% note for the remaining balance. The note is to be paid in three annual end-of-year payments of $81,487 each, with the first payment on December 31, Year 1. Each payment includes interest on the unpaid balance plus principal.

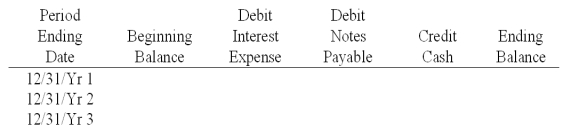

(1) Prepare a note amortization table using the format below:

(2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

Correct Answer:

Verified

(1)

12/31/Yr 1:

12/31/Yr 1:

Interest expense: $210...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Interest expense: $210...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The use of debt financing insures an

Q50: The market value or issue price of

Q54: Bonds that have interest coupons attached to

Q55: The debt-to-equity ratio is calculated by dividing

Q56: The present value of an annuity factor

Q58: The carrying amount of bonds at maturity

Q59: Explain the present value concept as it

Q111: _ bonds are bonds that are scheduled

Q116: An installment note is an obligation of

Q121: A discount on bonds payable occurs when