Essay

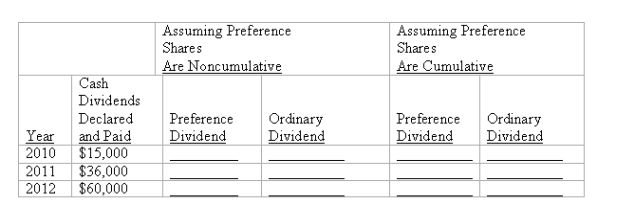

A company was organized in January 2010 and has 2,000 $100 par value, 10%, nonparticipating preference shares outstanding and 30,000 $10 par value ordinary shares outstanding. It has declared and paid cash dividends each year as shown below. Calculate the total dividends distributed to each class of shareholder under each of the assumptions given.

Correct Answer:

Verified

Preference dividend...

Preference dividend...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: A company declared a $0.55 per share

Q24: The dividend yield is computed by dividing:<br>A)

Q25: A corporation began business this year. The

Q26: Stated value of no-par share is:<br>A) Another

Q29: A preference share which confers no right

Q30: The price-earnings ratio reveals information about the

Q31: A company declared a $0.50 per share

Q32: The annual amount of cash dividends distributed

Q33: A corporation sold 14,000 $10 par value

Q109: Book value per share reflects the value