Essay

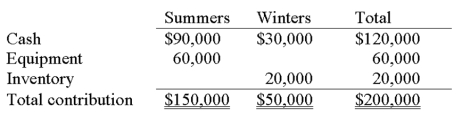

Summers and Winters formed a partnership on January 1. Summers contributed $90,000 cash and equipment with a market value of $60,000. Winters' investment consisted of: cash, $30,000; inventory, $20,000; all at market values. Partnership net income for year 1 and year 2 was $75,000 and $120,000, respectively.

1. Determine each partner's share of the net income for each year, assuming each of the following independent situations:

(a) Income is divided based on the partners' failure to sign an agreement.

(b) Income is divided based on a 2:1 ratio (Summers: Winters).

(c) Income is divided based on the ratio of the partners' original capital investments.

(d) Income is divided based on interest allowance of 12% on the original capital investments; salary allowance to Summers of $30,000 and Winters of $25,000; and the remainder to be divided equally.

2. Prepare the journal entry to record the allocation of the Year 1 income under alternative (d) above.

Part 1: Calculation of partners' capital contributions:

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Salary allowances are reported as salaries expense

Q42: Armstrong withdraws from the FAP Partnership. The

Q43: Mutual agency means<br>A) Creditors can apply their

Q45: When a partner is unable to pay

Q46: Partners' withdrawals of assets are:<br>A) Credited to

Q47: Partnership accounting:<br>A) Is the same as accounting

Q48: Mutual agency implies that each partner in

Q49: In a partnership agreement, if the partners

Q68: A partnership that has at least two

Q73: What are the ways a partner can