Essay

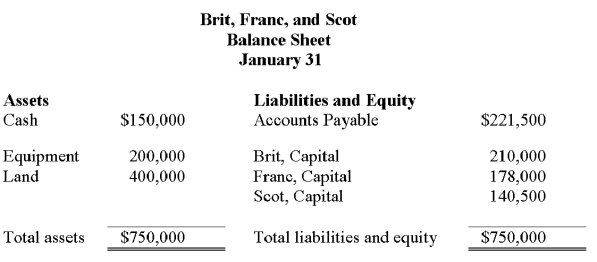

Brit, Franc, and Scot who share income and loss in a 2:2:1 ratio, plan to liquidate their partnership. At liquidation, their balance sheet appears as follows. Prepare journal entries for (a) the sale of land and equipment sold as a package for $500,000, (b) the allocation of the gain or loss, (c) the payment of the liabilities, and (d) the distribution of cash to the individual partners.

Correct Answer:

Verified

Correct Answer:

Verified

Q94: A partnership has an unlimited life.

Q97: Jane and Castle are partners and share

Q98: Partnership accounting:<br>A) Uses a capital account for

Q100: Smith, West, and Krug form a partnership.

Q101: Assume that the S & B partnership

Q102: A partnership designed to protect innocent partners

Q103: Nguyen invested $100,000 and Hansen invested $200,000

Q104: Basketball Products LP is organized as a

Q113: A capital deficiency can arise from liquidation

Q115: If partners agree on how to share