Essay

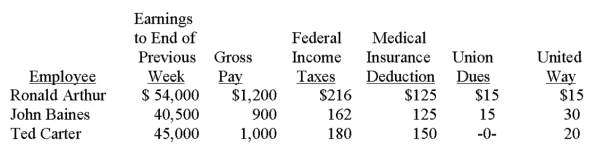

The payroll records of a company provided the following data for the weekly pay period ended December 7:

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A company had fixed interest expense of

Q35: Times interest earned is computed by dividing

Q36: Starling Company sells merchandise for $24,000 cash

Q38: Unearned revenues are liabilities.

Q39: A single liability can be divided between

Q40: Unearned revenues are amounts received _ for

Q41: All of the following statements related to

Q42: If the times interest ratio:<br>A) Increases, then

Q119: What are known current liabilities? Cite at

Q129: A _ is a written promise to