Essay

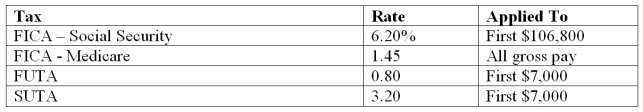

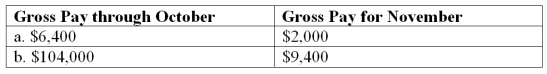

Halo Company provides you with following information for two of its employees. The company is subject to the following taxes.

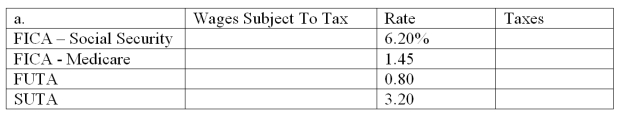

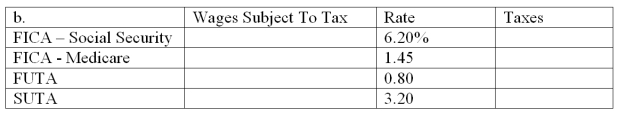

Compute amounts for each of these four taxes as applied to each employee's gross earnings for November.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q168: On November 1, Carter Company signed a

Q169: Pastimes Co. offers its employees a bonus

Q170: An employee earned $4,300 working for an

Q171: Salary expense represents net pay which is

Q172: Arena Sports receives $31,680,000 cash in advance

Q174: Phil Phoenix is paid on a monthly

Q175: A special bank account used solely for

Q176: The times interest earned ratio reflects:<br>A) A

Q177: A company sold $12,000 worth of trampolines

Q178: Sales taxes payable is credited and cash