Multiple Choice

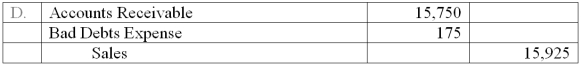

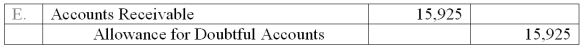

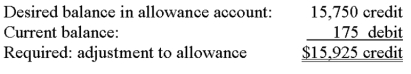

A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $175. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

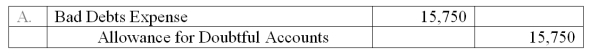

A) Option A

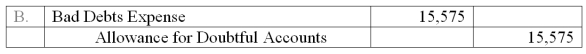

B) Option B

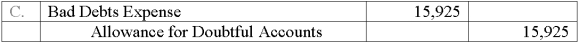

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q136: A Company had net sales of $23,000

Q137: When the maker of a note honors

Q138: A _ is a signed promise to

Q139: Electron borrowed $75,000 cash from TechCom by

Q140: The person who signs a note receivable

Q142: Installment accounts receivable are classified as current

Q143: Calculate the amount of interest that would

Q144: Pledging receivables:<br>A) Allows firms to raise cash.<br>B)

Q145: Paoli Pizza bought $5,000 worth of merchandise

Q146: A company receives a 10%, 90-day note