Essay

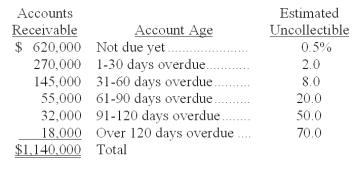

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Companies follow both the matching principle and

Q27: On August 9, Pierce Company receives a

Q28: The interest accrued on $6,500 at 6%

Q29: A company received a $1,000, 90-day, 10%

Q31: Companies can report credit card expense as

Q32: The process of using accounts receivable as

Q33: A company factored $45,000 of its accounts

Q34: Tecom had net sales of $315,000 and

Q35: The use of an allowance for bad

Q171: The advantage of the allowance method of