Essay

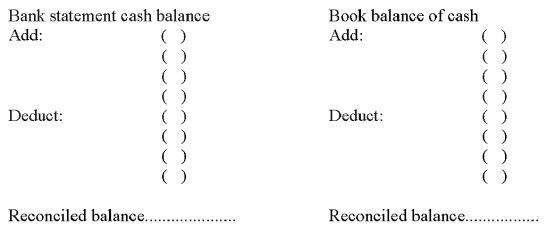

Following are seven items a through g that would cause Xavier Company's book balance of cash to differ from its bank statement balance of cash.

a. A service charge imposed by the bank.

b. A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c. A customer's check returned by the bank is marked "Not Sufficient Funds(NSF)".

d. A deposit that was mailed to the bank on the last day of the current month and is unrecorded on this month's bank statement.

e. A check paid by the bank at its correct $190 amount was recorded in error in the company's Check Register at $109.

f. An unrecorded credit memorandum indicated that bank had collected a note receivable for Xavier Company and deposited the proceeds in the company's account.

g. A check was written in the current period that is not yet paid or returned by the bank.

Indicate where each item a through g would appear on Xavier Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Correct Answer:

Verified

Correct Answer:

Verified

Q84: The document that is an itemized statement

Q86: The entry necessary to establish a petty

Q88: Discuss the purpose of a bank reconciliation.

Q90: Principles of internal control include all of

Q91: When a voucher system is used, recording

Q92: A company records purchases using the net

Q93: Internal control in technologically advanced accounting systems

Q94: An internal control system consists of the

Q98: Explain the difference between cash and cash

Q179: A _ is a document explaining the