Essay

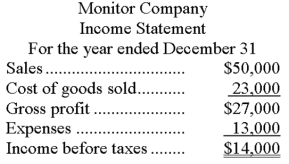

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Correct Answer:

Verified

a. If ending inventory is $300 higher us...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q113: The days' sales in inventory ratio is

Q181: A company's warehouse was destroyed by a

Q182: Flaxco purchases inventory from overseas and incurs

Q184: The inventory valuation method that has the

Q185: When taking a physical count of inventory,

Q187: On July 24 of the current year,

Q188: Using the information given below for a

Q189: A company had the following purchases during

Q190: Acceptable methods of assigning specific costs to

Q191: An advantage of LIFO is that it