Essay

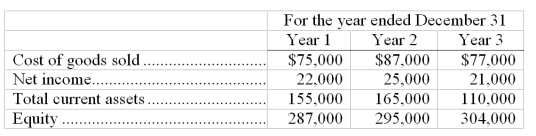

The City Store reported the following amounts on their financial statements for Year 1, Year 2, and Year 3:

It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: To avoid the time-consuming process of taking

Q74: The _ method of assigning costs to

Q76: Goods in transit are included in a

Q78: Perch Company reported the following purchases and

Q80: A company made the following merchandise purchases

Q81: A company made the following merchandise purchases

Q82: A company made the following merchandise purchases

Q84: A company has inventory of 15 units

Q174: The reasoning behind the retail inventory method

Q212: When units are purchased at different costs