Essay

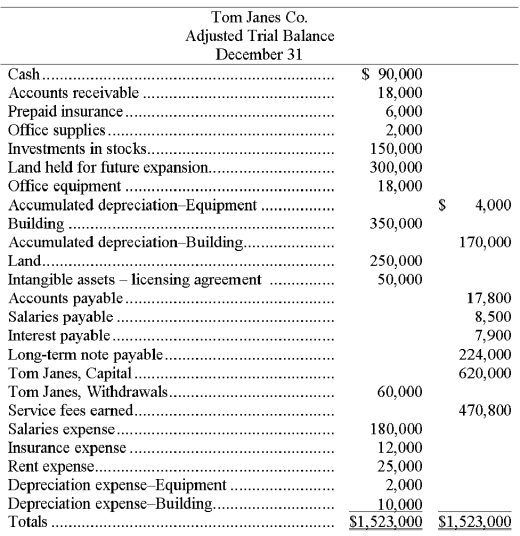

The following year-end adjusted trial balance is for Tom Janes Co. at the end of December 31. The credit balance in Tom Janes, Capital at the beginning of the year, January 1, was $320,000. The owner, Tom Janes, invested an additional $300,000 during the current year. The land held for future expansion was also purchased during the current year.

Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

2. Using the information presented:

(a) Calculate the current ratio. Comment on the ability of Tom Janes Co. to meets its short-term debts.

(b) Calculate the debt ratio and comment on the financial position and risk analysis of Tom Janes Co.

(c) Using the account balances to analyze the financial position of Tom Janes Co., why would the owner need to invest an additional $300,000 in the business when the business is already profitable and the owner had an existing capital balance of $320,000?

Correct Answer:

Verified

Net income $470,800 - $180,000 - $12,00...

Net income $470,800 - $180,000 - $12,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Long-term investments can include land held for

Q96: Use the information in the adjusted trial

Q97: The adjusted trial balance of the Thomas

Q99: The following information is available for Crandall

Q100: J. Awn, the proprietor of Awn Services,

Q102: The following are the steps in the

Q103: The unadjusted trial balance of Quick Delivery

Q105: Reversing entries:<br>A) Are optional.<br>B) Are mandatory.<br>C) Correct

Q120: The closing process is a step in

Q153: A post-closing trial balance is a list