Essay

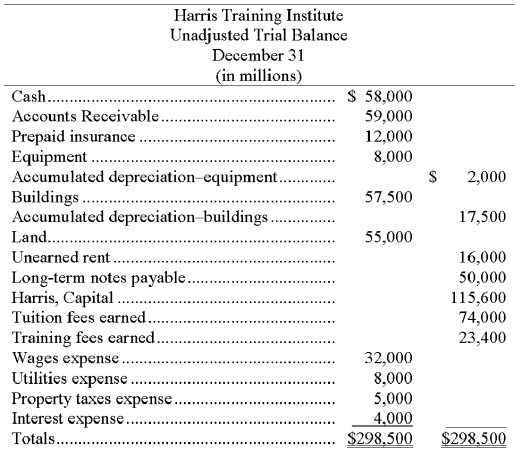

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. If these adjustments are not recorded, what is the impact on net income? Show calculation for net income without the adjustments and net income with the adjustments. Which one gives the most accurate net income? What accounting principles are being violated if the adjustments are not made?

Additional information items:

a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Correct Answer:

Verified

The accrual basis gives the most accurat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q156: A fiscal year refers to an organization's

Q171: In preparing statements from the adjusted trial

Q194: The cash basis of accounting commonly results

Q196: It is acceptable to record prepayment of

Q197: An adjusting entry could be made for

Q198: Pfister Co. leases an office to a

Q201: Ned's net income was $780,000; its net

Q202: What is the usual order in which

Q204: On May 1, Carter Advertising Company received

Q208: Before an adjusting entry is made to