Essay

After preparing an (unadjusted) trial balance at year-end, G. Chu of Chu Design Company discovered the following errors:

1. Cash payment of the $225 telephone bill for December was recorded twice.

2. Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes Payable for $1,000.

3. A $900 cash withdrawal by the owner was recorded to the correct accounts as $90.

4. An additional investment of $5,000 cash by the owner was recorded as a debit to G. Chu, Capital and a credit to Cash.

5. A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

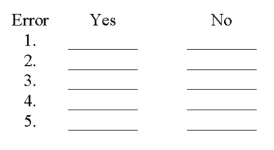

Using the form below, indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The journal is known as a book

Q87: Source documents provide evidence of business transactions

Q88: A report that lists accounts and their

Q89: The owner's withdrawal account normally has a

Q90: A $130 credit to Office Equipment was

Q91: A record in which the effects of

Q95: Which of the following statements describing the

Q96: FastForward purchased $25,000 of equipment for cash.

Q97: Stride Along has total assets of $425

Q107: The debt ratio is calculated by dividing