Essay

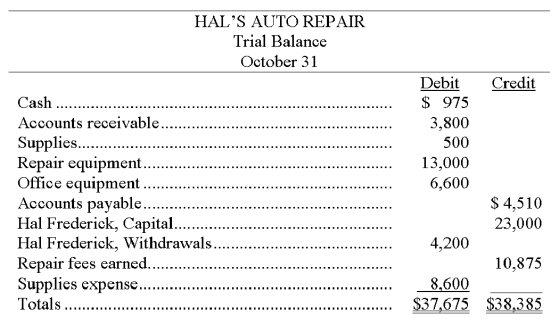

The following trial balance is prepared from the general ledger of Hal's Auto Repair.

Because the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

1. A purchase of supplies on account for $245 was posted as a debit to Supplies and as a debit to Accounts Payable.

2. An investment of $500 cash by the owner was debited to Hal Frederick, Capital and credited to Cash.

3. In computing the balance of the Accounts Receivable account, a debit of $600 was omitted from the computation.

4. One debit of $300 to the Hal Frederick, Withdrawals account was posted as a credit.

5. Office equipment purchased for $800 was posted to the Repair Equipment account.

6. One entire entry was not posted to the general ledger. The transaction involved the receipt of $125 cash for repair services performed for cash.

Prepare a corrected trial balance for the Hal's Auto Repair as of October 31.

Correct Answer:

Verified

aCash: Balance $975 + $1,000 (2) + 125 (6...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q152: Explain how accounts are used in recording

Q153: The _ is a record containing all

Q154: Dolly Barton began Barton Office Services in

Q155: Josephine's Bakery had the following assets and

Q156: Inge Industries received $3,000 from a customer

Q158: An account balance is:<br>A) The total of

Q159: A column in journals and ledger accounts

Q160: Of the following accounts, the one that

Q161: David Roberts is a real estate appraiser.

Q162: During the month of March, Cooley Computer