Multiple Choice

Figure 8-7

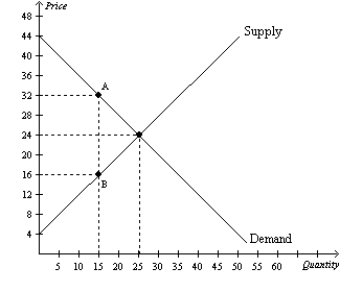

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-7. Suppose a 20th unit of the good were sold by a seller to a buyer. Which of the following statements is correct?

A) For the 20th unit, the difference between the buyer's value and the seller's cost is less than the tax per unit.

B) For the 20th unit, the difference between the buyer's value and the seller's cost is greater than the tax per unit.

C) For the 20th unit, the difference between the buyer's value and the seller's cost is equal to the tax per unit.

D) It makes sense for the buyer to buy and for the seller to sell the 20th unit, with or without the tax in place.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Figure 8-5<br>Suppose that the government imposes a

Q10: Which of the following is a tax

Q53: Figure 8-2<br>The vertical distance between points A

Q57: The deadweight loss from a tax of

Q59: Figure 8-13 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-13

Q60: Deadweight loss measures the loss<br>A)in a market

Q72: Figure 8-9<br>The vertical distance between points A

Q100: The loss in total surplus resulting from

Q124: Economist Arthur Laffer made the argument that

Q192: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10