Multiple Choice

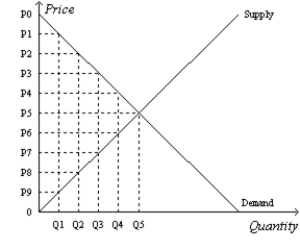

Figure 8-10

-Refer to Figure 8-10.Suppose the government imposes a tax that reduces the quantity sold in the market after the tax to Q2.The price that sellers receive is

A) P0.

B) P2.

C) P5.

D) P8.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q43: Tom walks Bethany's dog once a day

Q44: A tax on a good<br>A)gives buyers an

Q45: Figure 8-7<br>The vertical distance between points A

Q46: When the price of a good is

Q47: Taxes cause deadweight losses because taxes<br>A)reduce the

Q49: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q50: Figure 8-9<br>The vertical distance between points A

Q51: Figure 8-9<br>The vertical distance between points A

Q52: When a tax is levied on a

Q53: Figure 8-2<br>The vertical distance between points A