Multiple Choice

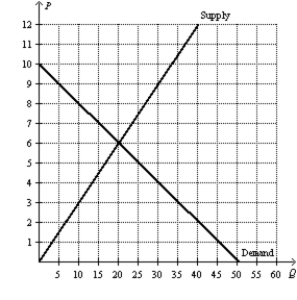

Figure 8-13

-Refer to Figure 8-13.Suppose the government places a $5 per-unit tax on this good.The tax causes the price paid by buyers to

A) decrease by $5.

B) increase by $5.

C) increase by $3.

D) increase by $2.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-1

Q59: Figure 8-13 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-13

Q60: Deadweight loss measures the loss<br>A)in a market

Q61: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q63: Figure 8-9<br>The vertical distance between points A

Q64: The government's benefit from a tax can

Q65: Figure 8-7<br>The vertical distance between points A

Q67: Figure 8-2<br>The vertical distance between points A

Q150: Scenario 8-1<br>Erin would be willing to pay

Q197: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-1