Multiple Choice

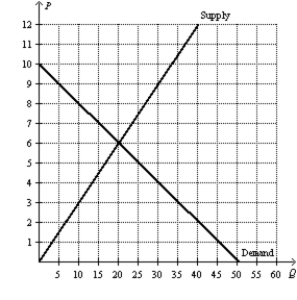

Figure 8-13

-Refer to Figure 8-13.Suppose the government places a $5 per-unit tax on this good.The tax causes the price received by sellers to

A) decrease by $5.

B) decrease by $3.

C) decrease by $2.

D) increase by $5.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Figure 8-1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7555/.jpg" alt="Figure 8-1

Q120: Figure 8-6<br>The vertical distance between points A

Q121: Figure 8-12 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-12

Q122: When a tax is levied on a

Q124: Figure 8-7<br>The vertical distance between points A

Q126: Tom walks Bethany's dog once a day

Q127: Suppose Rebecca needs a dog sitter so

Q128: Figure 8-13 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-13

Q129: Figure 8-2<br>The vertical distance between points A

Q130: Figure 8-13 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-13