Multiple Choice

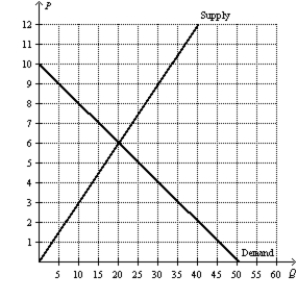

Figure 8-13

-Refer to Figure 8-13. Suppose the government places a $5 per-unit tax on this good. The loss of consumer surplus resulting from this tax is

A) $80.

B) $40.

C) $30.

D) $10.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Sellers of a product will bear the

Q26: Figure 8-5<br>Suppose that the government imposes a

Q44: The deadweight loss from a tax<br>A)does not

Q72: A tax places a wedge between the

Q85: Figure 8-11 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-11

Q107: Figure 8-10 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-10

Q117: Taxes affect market participants by increasing the

Q142: Figure 8-4<br>The vertical distance between points A

Q173: Figure 8-6<br>The vertical distance between points A

Q276: Scenario 8-3<br>Suppose the market demand and market