Multiple Choice

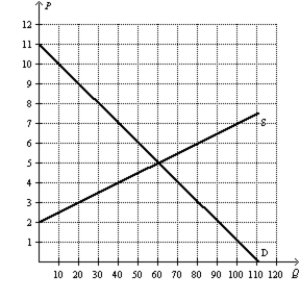

Figure 8-22

-Refer to Figure 8-22.Suppose the government changed the per-unit tax on this good from $3.00 to $1.50.Compared to the original tax rate,this lower tax rate would

A) increase tax revenue and increase the deadweight loss from the tax.

B) increase tax revenue and decrease the deadweight loss from the tax.

C) decrease tax revenue and increase the deadweight loss from the tax.

D) decrease tax revenue and decrease the deadweight loss from the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: An increase in the size of a

Q4: In the early 1980s,which of the following

Q5: Assume that for good X the supply

Q8: Figure 8-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-22

Q8: Figure 8-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-22

Q9: Figure 8-24.The figure represents the relationship between

Q10: Figure 8-21 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-21

Q11: The Laffer curve illustrates that<br>A)deadweight loss rises

Q79: Suppose the government increases the size of

Q133: If the tax on a good is