Multiple Choice

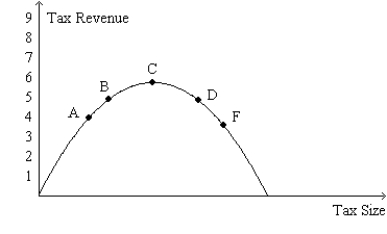

Figure 8-24.The figure represents the relationship between the size of a tax and the tax revenue raised by that tax.

-Refer to Figure 8-24.For an economy that is currently at point D on the curve,a decrease in the tax rate would

A) decrease consumer surplus.

B) decrease producer surplus.

C) increase tax revenue.

D) increase the deadweight loss of the tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: The Laffer curve relates<br>A)the tax rate to

Q38: Figure 8-19<br>The vertical distance between points A

Q39: Which of the following statements is true

Q40: Which of the following ideas is the

Q41: Figure 8-22 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-22

Q43: Which of the following statements correctly describes

Q44: In which of the following cases is

Q45: Suppose a tax of $0.50 per unit

Q47: If the tax on a good is

Q63: In which of the following instances would